The Indian equity market has given some stellar returns since Diwali 2020 as Nifty50 surged over 40 percent. Despite the hammering of the economy amid the devastating coronavirus, the market managed to reward its investors with some handsome gains.

The benchmark index Sensex has gained about 50 percent while midcap and smallcap indices have gained 85 percent and 87 percent, respectively.

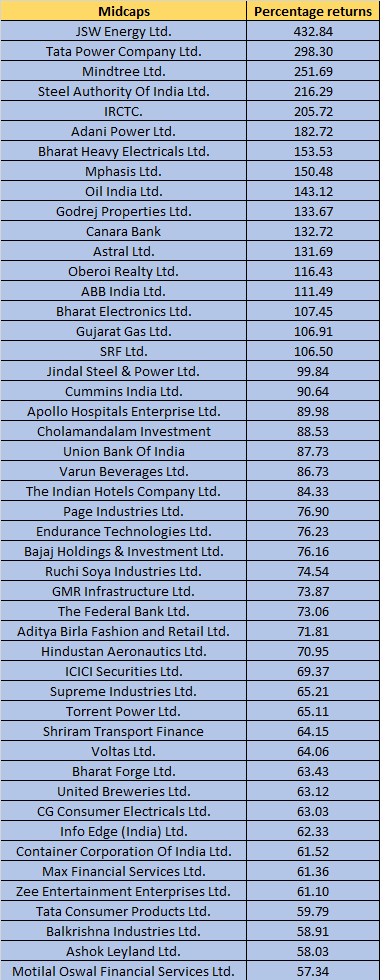

The midcap index has surged over 85 percent in the same period with almost 100 top companies giving returns of up to 432 percent. The top names included JSW Steel, Tata Power Company Mindtree and Steel Authority of India which surged between 200-400 percent.

On the other hand, close to 350 stocks from the smallcap index surged over 100 percent in the last 1 year including names like Brightcom Group which surged 1625 percent followed by Nahar Spinning Mills, JTL Infra, Olectra Greentech, GRM Overseas, Tata Teleservices, Ganesh Housing Corporation, Share India Securities, RattanIndia Enterprises, Goldiam International and Elecon Engineering Company among others which jumped 500-1000 percent each.

Market analysts are of the view that the broader outlook should continue to remain positive as far as domestic factors are concerned and quality names in the midcap and smallcap space are likely to do well next year as well.

According to Gaurav Garg, Head of Research at CapitalVia Global Research Limited, the broader indices have given a stellar rally this year with midcap index rising 67.40 percent and smallcap index surging 78.14 percent since last Diwali.

“In my view, quality stocks from these indices might do well next year as well with a decent surge in top line growth as the pandemic is on the verge of getting over. However, valuations are on a higher side in some of the pockets which include mid-cap and small cap tech stocks and some commodity stocks,” he said.

“Power, auto ancillaries and specialty chemical stocks might do well, and investors should try to stick with industry leaders. Auto-ancillary companies like Endurance Technologies, Minda industries and Gabriel India look good. We expect decent upside which is roughly 15%-25% from current levels and investors should look to accumulate these stocks at any healthy correction,” he added.

Narendra Solanki, Head- Equity Research (Fundamental) at Anand Rathi Shares & Stock Brokers feels that overall, the broader returns for almost all key sectors have been positive as we have seen improvement in various economic indicators over the past few months after unlock post second wave of Covid. Performance wise, since last Diwali the top performing sectors in our markets are metals, realty, power, consumer durables and capital goods which have given returns to the tune of about 112%, 107%, 78%, 68.5% and 67.2% respectively. The least performing sectors in the same period are FMCG, healthcare, auto and banks giving returns of about 21 percent, 25.5 percent, 34.4 percent, 36 percent respectively.

“We think that going ahead growth should continue to be strong for most sectors. However, what we have seen so far in the current results season is that there are few misses in profitability of few companies which is understandably due to supply side issues leading to delays in shipment and/or higher logistics costs, sudden rise in raw materials prices to name a few. The market has also likewise reacted to the numbers and we have seen some adjustments for the same. This trend should reverse in H2 of current fiscal and more so by Q4-FY22,” he said.

“Overall, the broader outlook should continue to remain positive as far as domestic factors are concerned with some expectation of volatility due to external global factors like Covid situation, inflation concerns and US Fed comments on taper and rates should be watched out for. Consistently performing sectors like IT, chemicals, consumer and manufacturing which are on cusp of turning around like financials, infra, realty etc. are looking good for the mid-term perspective,” Solanki added.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.