Considering the recent behaviour of the market, it is pretty clear that the bulls are not willing to let loose their firm grip so easily, says Sameet Chavan of Angel One.

Sunil Shankar Matkar

October 11, 2021 / 08:19 AM IST

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

It was a great week for the equity market as the benchmark indices rallied 2 percent, marching towards record highs seen a couple of weeks back. The BSE Sensex closed above the psychological 60,000 mark and the Nifty50 ended at record closing high, driven by auto, IT stocks and Reliance Industries.

The market received consistent buying support at every fall, which clearly indicated that bulls did not want to lose the game. And, as a result, the index could cross 18,000 mark if the momentum is sustained. Experts, however, advised against taking aggressively long positions.

“Considering the recent behaviour of the market, it is pretty clear that the bulls are not willing to let loose their firm grip so easily. But we reiterate that it is that sort of phase of the market, which may not be easy to participate in,” said Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One.

“We are not at all convinced about trading aggressively on the long side at this moment. Yes, there could be odd thematic moves that can be focused on, but do not want to go all guns blazing at such elevated levels,” he said.

As far as the levels are concerned, Sameet Chavan feels 17,900–17,950 remains to be a sturdy wall and on the flipside, 17,600 has become a sacrosanct support now. “The way we are following the US markets of late; all eyes are on their movement.”

Here are 10 trading ideas by experts for the next 3-4 weeks. Returns are based on October 8 closing prices:

Expert: Shrikant Chouhan, head of equity research (retail) at Kotak Securities

Larsen & Toubro: Buy | LTP: Rs 1,726.90 | Stop Loss: Rs 1,665 | Target: Rs 1,850 | Return: 7.1 percent

The stock is trading near 20-day SMA (simple moving average) along with Higher High and Higher Low series pattern. It indicates a strong uptrend that’s likely to continue in the near term.

In addition, on daily and intraday charts, it has formed higher low formation which is broadly positive for Larson & Toubro. On daily charts, Rs 1,665 could act as a sacrosanct support for the stock and sustenance above the same can take it to Rs 1,850.

ICICI Bank: Buy | LTP: Rs 703.40 | Stop Loss: Rs 680 | Target: Rs 750 | Return: 10.3 percent

After a short-term price correction from Rs 735 to Rs 690, the stock is trading near 50-day SMA. After the short-term correction, it has been consistently taking support between Rs 690 to Rs 680 price ranges.

In addition, on daily and intraday charts, it has formed promising double bottom formation which suggests further uptrend. In the near future, Rs 680 would be the key support level for short-term traders. Above the same reversal formation is likely to continue up to Rs 750.

Bajaj Auto: Buy | LTP: Rs 3,815.55 | Stop Loss: Rs 3,690 | Target: Rs 4,090 | Return: 7.2 percent

From the last couple of months, the stock is trading within the range of Rs 3,700 to Rs 3,900. It is trading near 200 and 50-day SMA with promising double-bottom formation.

The trading setup indicates strong possibility of a fresh breakout in the near future. Unless it is trading below Rs 3,690, positional traders retain an optimistic stance and look for a target Rs 4,090. Fresh buying can be considered now and on dips, if any, between Rs 3,820 and Rs 3,775 levels with a stop loss below Rs 3,690.

Expert: Ashis Biswas, Head of Technical Research at CapitalVia Global Research

Coromandel International: Buy | LTP: Rs 859.15 | Stop Loss: Rs 760 | Target: Rs 1,000 | Return: 16.4 percent

The stock has been following an uptrend. We can see channel pattern in daily chart and traded in the range of channel lines. The stock has taken the support of 55 & 200-day EMA (exponential moving average) line.

The stock traded around the level of Rs 864 and we can expect it to reach Rs 1,000. We have observed indicators like EMA and MACD suggesting that the momentum will continue. We recommend a buy for Coromandel above Rs 864 with the target of Rs 1,000. Investors are advised to maintain a stop loss at Rs 760.

UPL: Buy | LTP: 738 | Stop Loss: Rs 630 | Target: Rs 850 | Return: 15.2 percent

UPL has been rising from the trendline support in the daily charts. The stock has risen from the support of 200 EMA line. We expect a bullish sentiment in the stock from the support of 200 EMA line.

We have observed momentum indicators like RSI (relative strength index), indicating that the momentum in the stock is likely to continue. We recommend a buy in UPL above Rs 740 with a target of Rs 850 with a stop loss of Rs 630.

LIC Housing Finance: Buy | LTP: Rs 442.25 | Stop Loss: Rs 360 | Target: Rs 530 | Return: 19.8 percent

LIC Housing Finance following a bullish trend in daily chart, the stock has taken the support of 55 and 200-day EMA line. The stock has taken the support of EMA line around Rs 425. It has also taken reversal in monthly chart.

We have observed momentum indicators like RSI and MACD, suggesting that the momentum will sustain. We recommend a buy in LIC Housing Finance above Rs 442 with the target of Rs 530. Investors are advised to maintain a stop loss at Rs 360.

Expert: Vinay Rajani, Senior Technical & Derivative Analyst at HDFC Securities

Amber Enterprises: Buy | LTP: Rs 3,502.2 | Stop Loss: Rs 3,335 | Target: Rs 3,850 | Return: 9.9 percent

The stock has broken out from the bullish ‘Flag’ pattern on the daily chart and is on the verge of posting an all-time high above Rs 3,662. On October 8, it surged 3.5 percent with a significant jump in volumes.

Primary trend of the stock has been bullish as it has been holding above all important moving averages. The stock has been forming higher tops and higher bottoms.

Bank of Baroda: Buy | LTP: Rs 88.10 | Stop Loss: Rs 83 | Target: Rs 97 | Return: 10.1 percent

The stock has broken out from the ‘Inverted Head and Shoulder’ pattern on the daily chart. Price breakout is accompanied with rising volumes. The PSU bank index has also broken out from the medium term downward sloping trend line on the weekly chart.

The stock has given the highest weekly close since February 19. It is placed above its 20, 50 and 100 DMA. Indicator and Oscillator setup has been holding bullish on weekly charts. Short-term moving averages are placed above medium to long term moving averages.

IndiaMART InterMESH: Buy | LTP: Rs 8,805.75 | Stop Loss: Rs 8,340 | Target: Rs 9,750 | Return: 10.7 percent

The stock has broken out from the “Symmetrical Triangle” pattern on the daily chart. Price breakout is accompanied with rising volumes. Indicator and Oscillator setup has been showing bullish trend on the weekly charts.

Short term moving averages are placed above medium term moving averages. Stock has been forming higher tops and higher bottoms on weekly and monthly charts.

Expert: Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One

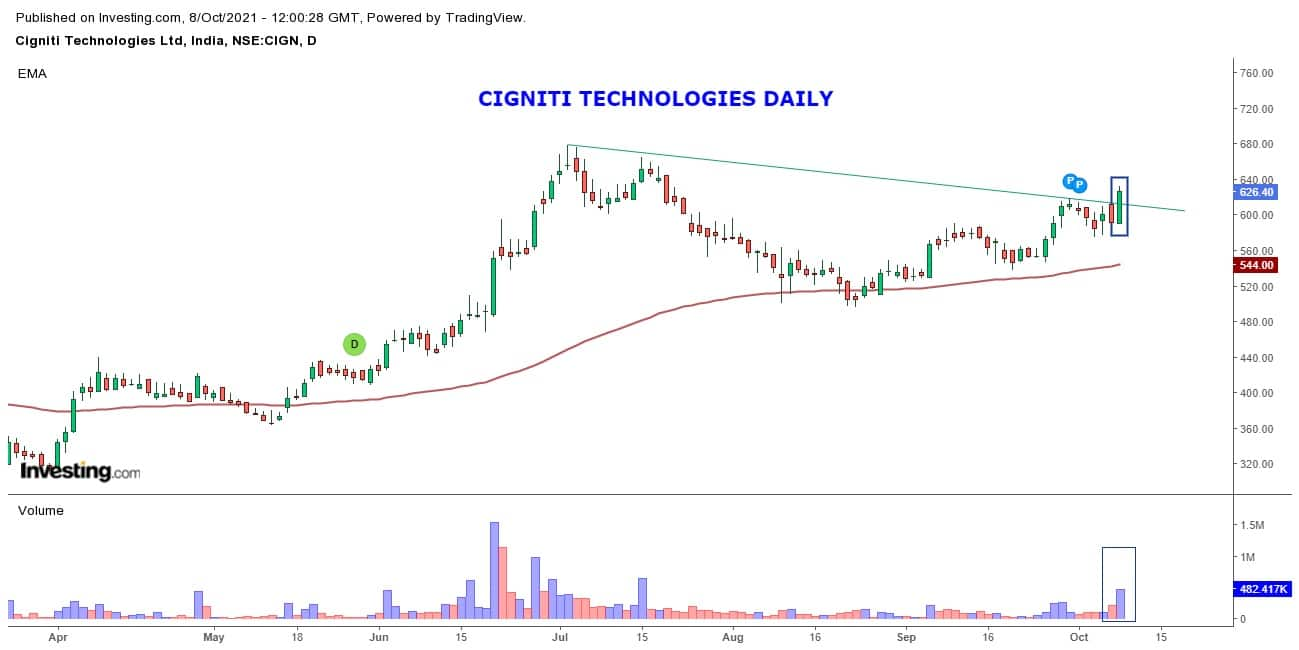

Cigniti Technologies: Buy | LTP: Rs 626.40 | Stop Loss: Rs 602 | Target: Rs 670 | Return: 7 percent

On Friday, the entire IT space was on a roll just ahead of the TCS numbers. Mostly, ‘Cigniti Technologies’ does not come into our recommendation list; but the way this smaller IT name moved on Friday, it has certainly caught our attention. On the daily time frame chart, we can witness a series of higher highs higher lows and now the momentum oscillator like ‘RSI-Smoothened’ is sloping upwards, which is a sign of strength.

We recommend buying for a short-term target of Rs 670. The stop loss can be placed at Rs 602.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.