The BSE PSU Index made a record high today as it touched 8,488 points which is a huge 93.8% jump from its 52 week low of 4,378 points. It has outpaced all other major indices like BSE Sensex, Nifty and Bank Nifty over the last 1 year. The market cap of the index has grown 3% in a week’s time and by about 43% from Jan’21.

![]()

The buoyancy is a result of the overall bullish market sentiment and renewed interest in PSUs due to government talks about disinvestment. The investors are seeing value in PSU stocks as they had been underperforming during the previous rallies and are now available at attractive valuations compared to other stocks which are now running at very high valuations and have now become risky.

As per Mr. Sanjiv Bhasin, Director IIFL Securities, “There is a complete rerating of PSU stocks on the back of government initiatives over the last one year like economies of banks, monopolies of power and infrastructure have got rerated as they now have more control without much of Govt. intervention. The Govt. did not intervene to control the fuel prices as they were going north-wards, companies were able to increase the gas prices in tandem with international prices. With the opening up of economy, the power requirement is at an all time high which is good news for power generation companies. The government has also stopped piece meal sell offs of PSUs that it was earlier doing through ETFs which has broght clarity on the disinvestment front. PSU stocks always had a great value but were lagging behind because of it’s role in managing them. If the Nifty is to cross 18K level, it will be able to now do so only on the basis of growth and momentum in PSU stocks.”

In the budget for FY 20-21, Govt. had announced an ambitious disinvestment / privatization target of PSU companies to the tune of Rs. 2.10 Lakh Crores while in the budget for FY 21-22, this target was set at Rs. 1.75 Lakh Crores. However, the entire program got stalled due to the pandemic last year as well as major part of this year.

As the COVID situation in the country is improving and economy is gradually gathering pace, Govt. has again reiterated their intent to conclude a host of transactions by March’22. The Department of Investment and Public Asset Management (DIPAM) had communicated during the Annual CII session in the month of Aug’21 that the privatization of Air India, BPCL, Shipping Corp of India, Pawan Hans, BEML and Neelachal Ispat Nigam Ltd would be completed this year.

So far, the Govt. has raised about Rs 8,368 Crores this year by selling stake in Axis Bank, NMDC Ltd and Housing and Urban Development Corp.

The transfer of control and ownership of these companies to private players would help improve the valuations of the stock market listed companies and release their true value.

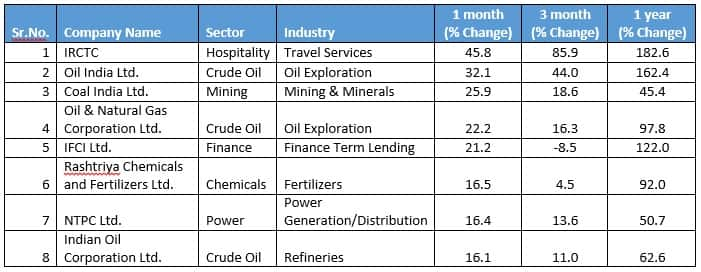

Top 10 Gainers on BSE PSU Index

The recent surge in fuel prices has also aided the cause of public sector fuel companies like ONGC, NTPC, Coal India, etc. Brent crude is touching $ 80/barrel and there is severe shortage of coal globally with countries like China shutting down their coal based thermal power plants. Natural Gas is playing above $ 25/mmbtu currently which was under $ 5/mmbtu last year.

In the Indian context, ONGC is the biggest beneficiary of this rise in fuel prices as for them it is a direct follow through with no subsidies to be shared now. So till the time the fuel prices are rallying, ONGC will reap the benefits and will see a positive momentum in its stock. Also, it is the largest oil producer in the country and is going to benefit from the worldwide shortage of crude. ONGC also stands to benefit from any potential deregulation of domestic gas prices.

Higher fuel prices are good news for Oil Marketing Companies like HPCL and BPCL. BPCL is due for privatization and has been garnering interest from the investors for quite some time now. HPCL is favored as it has the most profitable marketing business among OMCs.

Two of the largest Public Sector Banks, SBI and BOB, have performed reasonably well during the pandemic and are expected to give high double digit ROE in the near term. This optimism is fuelled by improved economic activity in the country, increasing credit growth, reduced cost of funds, improving operational efficiencies and removal of stressed assets from the books. This optimism can be seen in the surge of prices of these stocks over the past few months.

The metals sector has risen because of a steep rise in commodity prices and has seen the biggest gain over the past one year but over a shorter time frame of 1-3 months they have not performed that well.

Engineering companies like BEML and BEL have performed exceptionally and have risen in excess of 115% in the 1 year time frame. Over a shorter time frame of 1-3 months, their prices have improved in the region of 10%. This is at the back of strong order book from both the defence as well as the non-defence segment. BEML is also in the Govt. list of divestment because of which also it is in the radar of investors.

With the opening up of economy and resumption of travel for business and pleasure, IRCTC has benefitted the most. The stock has risen by 180% over one year and by almost 45% in the past one month. Investors still see a value in this stock given the position it enjoys in the travel space.

As per Mr. Shrikant Chouhan, Head of Equity Research (Kotak Retail), “inclusion of IRCTC and HAL has helped the index in a big way to reach these levels. Also, the government’s continued efforts to divest some state-owned companies would also be one of the triggers to send the index beyond the previous high levels.” He is particularly bullish on SAIL, Nalco, GAIL and BPCL based on their current fundamentals and reasonable valuation expected in the near future (12 months).

According to Shrikant, “The top choices are SAIL with a price target of 170, Nalco to reach the levels of 100, GAIL with a fair value of 190 and finally, BPCL on which we have a price target of 495.”

If the government is able to execute its intent for disinvestment properly and achieves a major portion of its target for this year, it will instill lot of confidence in investors and will continue generate interest in PSU stocks which are generally left behind because of the Govt. tag associated with them. This will also result in continued positive momentum in these stocks.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.