Nifty closed the week ended September 24 with another spectacular move of more than 4% since starting of this month. It continued the uptrend and touched a fresh all-time high, i.e. 17,935, and closed around 17,847.

The Nifty futures during this week ranged from 17335.00 to 17935, ending the week higher by around 1.39%. On the OI (open interest) front, short covering was witnessed in Nifty over the week gone by.

Bank Nifty, on the other hand, was volatile but ended the week flat with marginal loss of -30.6, Bank Nifty closed at 37,819.40.

Bank-Nifty over the week gone by traded between 38200 and 36600. On the OI front, short build was witnessed in Bank Nifty over the week gone by.

Further diving into the Nifty’s upcoming Weekly expiry, Call writers are showing aggression by building more position compared to Put writers. Nifty Vital resistance stands at 18,500 where nearly 56 lakh shares were added – highest among all – followed by immediate resistance at 18,000 with addition of 53L shares.

On the lower side, immediate support level is at 17,700 where nearly 37 lakh shares were added followed by 17,000 with highest addition of 46 lakh shares.

Looking at the Bank Nifty’s upcoming weekly expiry data, on the upper side, immediate resistance stands at 38,000 (20L share) followed by 39000 (20L shares). Whereas, on the downside, 37500 (11L shares) stand at the immediate support level and followed by 37000 (14L shares) as the vital support level.

India VIX, fear gauge, increased around 12.00% from 15.23 to 17.05 over the week.

India VIX is trading near the lowest level of pre-Covid crash. Cool off in the IV has given relaxation to market. Further, any downticks in India VIX can push the upwards momentum in Nifty.

Looking at the sentimental indicator, Nifty OI PCR for the week has increased from 1.151 to 1.275. Bank Nifty OIPCR over the week decreased from 0.963 to 0.901 compared to last Friday. Overall data indicates more of put writers over call writers in Nifty.

Moving further to the weekly contribution of sectors to Nifty. Most of the sectors across contributed positively except Metal, PSU Bank, Cement and Pharma. Private Bank and IT contributed nearly around 85 points each in Nifty approximately 235 points gain. NBFC and OIL were the top contributors followed by PVT Bank and IT.

Looking towards the top gainer & loser stocks of the week in the F&O segment. Godrej Properties topped by gaining over 35.50%, followed by ZEEL 24.50%, DLF 21.90%. Whereas, Tata Steel has lost over 8.7%, PI Industries -7.60 %, Jindal Steel -7.40% over the week.

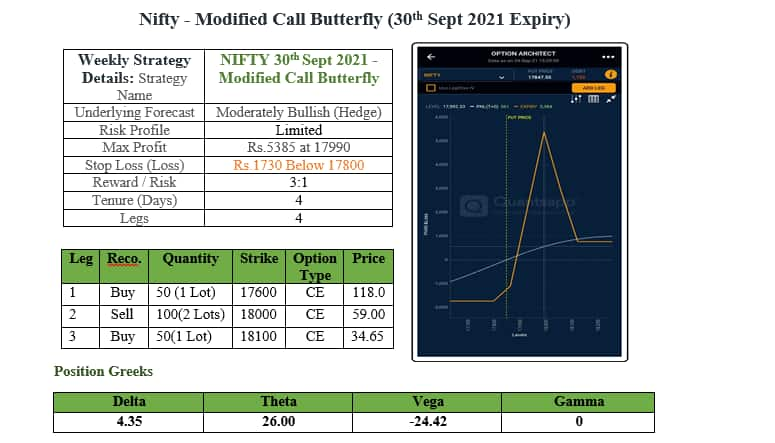

Considering the bullish momentum, the upcoming week can be approached with a low-risk strategy like Modified Call Butterfly in Nifty.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.