Indian shares were trading higher on August 31, a day after market benchmarks scaled new highs. The Sensex was up 171 points, or 0.30 percent, at 57,060.76, and the Nifty had added 52.80 points, or 0.31 percent, at 16,983.80 in the afternoon trade.

According to a report by Way2Wealth Research, the momentum indicator RSI (14) made a sharp up move till 78 and the stochastic oscillator was again headed to 97 levels, signalling an overbought scenario. Therefore, due to the sharp bounce in the previous session and the Nifty closing in on the resistance zone may lead to some profit booking. On the other hand, if the index goes past 17,000, it may extend the rally.

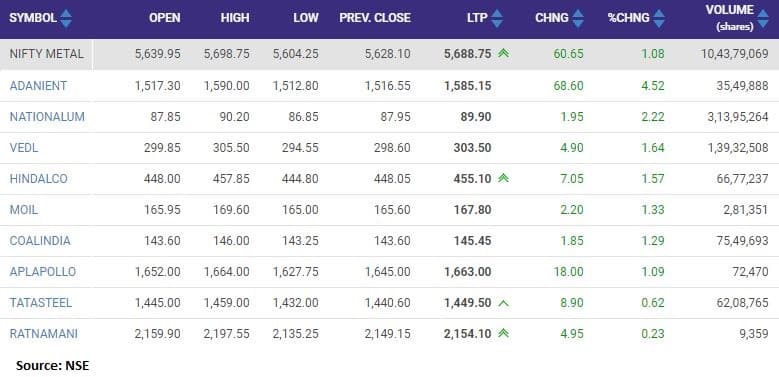

Sectors such as metal and PSU banks helped the market edge higher, with the metal index adding over a percent. The top gainers included NALCO and Tata Steel followed by MOIL, Hindalco Industries, Vedanta and Coal India.

Catch all the market action on our live blog

Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities, expects see volatility in the market. “Metal stocks are available at decent levels and after the Jackson Hole event, we would see fresh buying in the sector,” he said in an interview to Moneycontrol.

“Technically, they are available at decent levels, we would see fresh buying in the sector,” he added.

The Q1FY22 earnings were led by cyclicals such as metals, cement and oil & gas. These sectors, along with the IT, BFSI and pharma, may continue to see growth as economic activities pick pace and COVID-19 vaccination gathers momnetum.

“FY22 earnings growth is estimated to be led by (a) metals, which continue to benefit from strong price realisations, (b) BFSI which is expected to benefit from economic recovery as demand revives, and (c) strong earnings growth in export-oriented sectors such as technology and the healthcare,” said Motilal Oswal in its report.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own, and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.