The primary market remains in the spotlight this week as well with four initial public offerings from companies in different sectors expected to raise about Rs 14,806 crore, based on the higher end of the share price band.

The Nifty 50 hit a fresh record high of 16,349 on August 9 and foreign institutional investors, which were net sellers of more than Rs 7,200 crore in July, poured in more than Rs 1,200 crore in the first five trading sessions of August, which was a positive sign for the bulls.

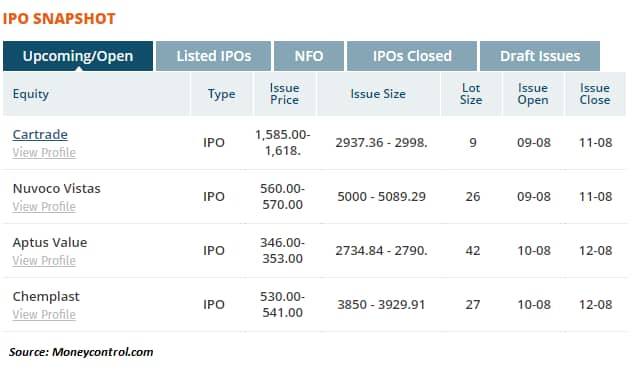

Four companies are selling shares through IPOs this week – CarTrade Tech and Nuvoco Vistas (August 9 to 11) and Aptus Value Housing Finance India and Chemplast Sanmar (August 10 to 12). Investors interested in only one or two IPOs could subscribe to CarTrade Tech and Chemplast Sanmar for listing and long-term gains, experts suggested.

CarTrade Tech, a multichannel auto platform, has set a price band of Rs 1,585-1,618 per share. Nuvoco Vistas, a cement company, will sell shares at Rs 560-570 each. Aptus Value, a retail-focused housing finance company, is offering shares at Rs 346-353, while Chemplast Sanmar, a manufacturer of specialty paste PVC resin, has set a price band at Rs 530-541 per equity share.

July-August 2021 would be considered the busiest months for us as well as investors to pick and invest in the best companies among the raining IPO offers. At first glance, among the four offers, retail investors can bet on CarTrade Tech to subscribe for listing gains,” said Prashanth Tapse, VP research at Mehta Equities.

The ask valuation for CarTrade, a profit-making, online multichannel auto platform, seems to be fully priced in, but the prospects look promising, experts said. The company owns brands including CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto and AutoBiz.

To Know All IPO Related News, Click Here

Its shares in the grey market were said to be selling at a 30-35 percent premium, so investors were betting big even before the IPO opened.

“The company has been consistently generating solid numbers for the past three years with growth before being hit by Covid, with revenue falling by 16 percent in FY21 to Rs 250 crore, down from Rs 300 crore in FY20,” said Gaurav Garg, head of research at CapitalVia Global Research. “Considering the future prospects and visibility of the business and first-mover advantage with profit on the books, investors can also look to invest for a medium to long-term perspective.”

Garg added that among the four IPOs this week, CarTrade may have a listing gain.

“Chemplast Sanmar may have an advantage over the competition in the long run. We’ve noticed a recent uptick in the demand for this sector due to the pandemic,” he said.

The holdings of retail investors (individuals with up to Rs 2 lakh shareholding) in companies listed on the National Stock Exchange reached an all-time high of 7.18 percent on June 30 from 6.96 percent as on March 31, according to primeinfobase.com, an initiative of PRIME Database Group.

Most IPOs in the past two months have received a massive response from retail investors, with issues getting subscribed multiple times. Experts see this as a sign of maturity among retail investors who are not afraid to take risks.

“We believe that good traction in IPOs can be seen in the upcoming four IPOs as well from the retail side. As of now, retail investors feel that there is no harm in putting money in IPOs as nothing will get affected even in case of non- allotment of shares,” said Astha Jain, a senior research analyst at Hem Securities. “We recommend investors put money in CarTrade for listing gains as well as long-term purposes as the company is a leading marketplace for automotive sales with a synergistic ecosystem and has proprietary end-to-end technology platforms with a focus on data science to provide solutions.”

The company is the only profitable automotive digital platform among peers with an asset-light model and decent EBIDTA margins, Jain added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.