The opportunity at hand is immense but so is the gestation period. With time, steep revenue multiples will degrade faster than the growth rate moderation, resulting in underperformance over other Internet plays with much better entry multiples, Dolat Capital has said in its report

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Zomato recently dominated headlines when the food delivery startup’s Rs 9,375-crore initial public offering (IPO) was subscribed 38.25 times and the listing, the first for a unicorn in India, lived up to the hype.

Market participants have made some stellar gains from Zomato but research and broking firm Dolat Capital has recommended a “sell” on the stock. It sees a 45 percent downside in the stock against its closing price of Rs 131 a share on August 6.

The company’s conquest-of-complete-ecosystem approach and steep revenue multiples, which will degrade faster than the growth rate moderation, will result in underperformance of the stock, it has said.

The food delivery giant Zomato made a stellar debut on Dalal Street on July 23 as the stock opened at Rs 116 on the NSE, a 52.63 percent premium to its final offer price of Rs 76. The listing price on the Bombay Stock Exchange was at Rs 115, up 51.32 percent.

Since its listing, the stock has surged over 72 percent as it closed at Rs 131 a share on August 6. The Gurugram-based company’s market capitalisation crossed the Rs 1-lakh-crore mark, standing at Rs 1,08,067.35 crore after the stellar debut, racing ahead of IOC, BPCL and Shree Cements.

Strong participation, especially from institutional investors and foreign funds, amid a limited number of available stocks may have lead to the stupendous rise in Zomato, experts say.

The Rs 9,375-crore initial public offering, which opened for subscription from July 14 to 16, saw the highest subscription in the last 13 years among IPOs valued at more than Rs 5,000 crore each.

Here’s why Dolat Capita thinks that the stock may slide 45% :

Zomato is set for the grand feast, but do consumers have the appetite?

Zomato achieved leadership status (around 45 percent+ market share in online food delivery) in the fast-growing $ 4-billion food-tech industry in India.

The company has grown at 62 percent revenue CAGR over FY16-21 and is expected to see multi-year hyper-growth, given the significant scope in terms of volume (transaction frequency, deeper reach in tier II, III cities) and some bit on pricing (AOVs) as increased urbanisation and rising female-working population trends would drive up need for online food ordering into eventual habit formation.

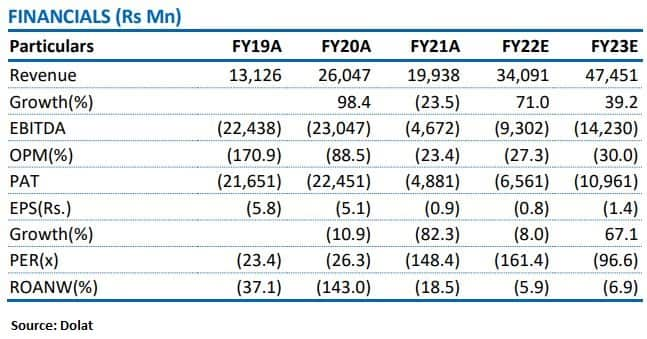

“We believe Zomato with its wide offering, deeper reach and untapped opportunity can drive revenue CAGR of 33 percent over FY21-FY30E, but in its conquest for complete ecosystem approach that, too, at a pan-India level would mean the profitability would have to wait for much longer than what market anticipates,” it said.

The opportunity at hand is immense but so is the gestation period and thus with time, the steep revenue multiples will degrade faster than the growth rate moderation, resulting in underperformance over other Internet plays with much better entry multiples, it added.

“We initiate coverage, with a sell rating and DCF based target of Rs 90 per share (implies 15.4x FY23 EV/Sales, 23x FY30 EV/EBIT),” Dolat Capital said.

Flywheel effect

Larger scale and sharper execution can bring the lower fulfilment cost, driving up customer experience and satisfaction, which in turn may drive up transaction frequency, giving it the flying wheel effect.

It has also been observed that customers who have stuck with the platform have also seen a significant increase in order frequency (in year 3/4 have gone up by 2.5x-3x). Thus, Zomato, at the moment, is investing heavily to grow cities and customers.

Subsidising all three parties

It is continuously investing in both new customer acquisition by entering newer cities and also on retaining and retargeting the existing customer pool through discounts on food and delivery cost —it will become free for around 16 percent Pro Plus customers.

At this moment, Zomato is subsidising all the three parties involved. Customers are being offered a discount on food, it is topping up the earnings for delivery partner as customer delivery pay-outs are inadequate and is offering discounts to restaurant partners that are at times higher than the take rate to drive up volumes.

Cash burn to continue

We believe it has already built up a strong brand and business model that can throw very strong cashflow if it is limited to few urban cities. However, the vision of the founder is clearly much larger, which, along with strong fresh fundraise in IPO/pre-IPO, investments in Grofers, very low online-food-ordering base and yet-to-recover order volumes (down 12 percent from peak), indicates sustainable cash burn for next few years at least.

On the other hand, UBS initiated coverage on Zomato with a “buy” rating and set a target price of Rs 165, a gain of about 26 percent from the August 6 close.

The Swiss brokerage expects Zomato to deliver CAGR of over 40 percent in revenue, making it one of the fastest-growing internet companies in the region. The food-delivery market is at a nascent stage compared with global peers.

Domestic brokerage firm JM Financial, which initiated coverage on Zomato with a buy rating and a 12-month target price of Rs 170, sees an upside of 29 percent and expects the company to deliver GOV/revenue CAGR of 48 percent over FY21-26 in its flagship food delivery business.

“We also expect a strong ramp-up in the Hyperpure business (revenue CAGR of 59 percent) but note that the decision to shut international market operations would negatively impact dining-out business in the near term,” JM Financial said in a report.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.