Last week, India started on top gear tracking the confident global sentiments and the newfound energetic domestic economy. All domestic economy indicators like sales volumes in the realty & auto sector, data like PMI, GST, corporate earnings, and exports suggested a strong recovery in the domestic market. This reduced the risk of a second wave impact on the economy and any possible impact in the future from the third wave.

Globally, continued accommodative stance by central banks, huge infrastructure package in the US and subsided bond yields led to a drop in liquidity risk. Risk-on was triggered, which led to a change in FIIs inflows to India from negative to positive, after a whopping gap of 4 months. The government’s plan to scrap the controversial retrospective tax policy too would have given a tailwind to FII’s view of the Indian market.

FIIs have turned net buyers in August. Last week they net brought Rs 2,600 crore compared to Rs 23,000 crore sold in the last month July and a total of Rs 41,200 crore in the four months of April to July 2021. FII inflows helped the main indices (heavyweights) to cross into new zone. Nifty50 was trading in a narrow range between 15,900 to 15500, during June & July.

Improved performance of main indices or largecaps is supported by a drop in global risk after the accommodative monetary & fiscal policy announcements. A similar monetary policy was expected in India from this week’s RBI meeting, which was perfectly in-line with market views. The most positive was the liquidity measures announced to conduct two more Government Securities Acquisition Programme (GSAP) auctions of Rs 25,000 crore each on August 12 and August 16. At the same time, Monetary Policy Committee (MPC) accepted that there is excess liquidity in the financial market. And introduced fortnightly VRRR (Variable rate reverse repo) auctions of Rs 2.5 trillion, Rs 3 trillion, Rs 3.5 trillion and Rs 4 trillion over coming weeks, to bring normal liquidity in the system.

Overall, healthy liquidity can be expected to be maintained in the system while the biggest risk is the rising inflation. CPI forecast has been increased decently to 5.7 percent from 5.1 percent for FY22. High global inflation & currency volatility have started to affect the monetary policy of other emerging markets. Few have started to increase interest rates, and some are planning to do in the future. In India, as surplus short-term liquidity is normalized, we can expect short-term rates to rise in the near-term.

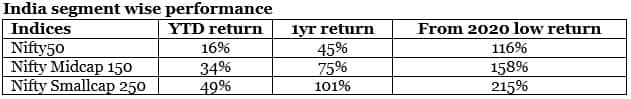

An important point to note this week is the better performance of main indices or largecaps while broad market is underperforming. Performance of micro & smallcap was very muted this week. They are consolidating after the super rally they had in 2020 & 2021.

On an average, smallcap have generated 3x and 2x times more return than largecaps, during the year and from 2020 low. Some healthy correction in mid & small caps will be required to bring some parity in the market segments. Long-term demand & supply law will come into picture given elevated current prices & valuations. In the coming months, be choosy & cautious while investing in mid & small caps, after the thrilling rally.

Some of the main factors for the strong performance of Mid & Small caps has been the rising new retail investors, high quality IPOs, mutual funds buying, high liquidity and recently the gains anticipated from unlocking. A good part of these reasons will continue to help the market. But at the same time, we can presume that good part of these benefits is reasonably priced in current stock prices. It is time to be rational, book part of your gains in mid & small caps, be selective and increase the mix of large caps, gold & debt papers in your portfolio.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.