While there are hundreds of stock market indicators and oscillators, most investors and traders only need a few. One of the most popular oscillators is RSI (Relative Strength Indicator). Created by a brilliant engineer, Welles Wilder, RSI tells when an index or a stock is overbought or oversold. Like most “bounded” oscillators, it has a reading from 0.0 to 100.0 on the chart.

“Overbought” is when a security makes an extended move to the upside (and is trading higher than its fair value). “Oversold,” conversely, is when a security makes an extended move to the downside (and is trading lower than its fair value).

Jeff Bierman, chief market technician at Theo Trade and a professor of finance at Loyola University Chicago, confirms: “RSI is a time-tested oscillator that is very accurate at identifying overbought and oversold conditions. It allows you to observe ‘risk management zones.’ Then you can evaluate whether the zone might be broken to the downside or upside.”

The purpose of RSI is to let you know if a market or stock is overbought or oversold and may reverse. It doesn’t mean that the security will reverse with 100% certainty, but it does indicate it’s in the danger zone.

How can you identify when a market or stock is overbought? Look at RSI on a weekly (or daily) stock chart. If RSI is 70 or higher, the security is overbought. If RSI falls to 30 or below, it is oversold. It’s really that simple.

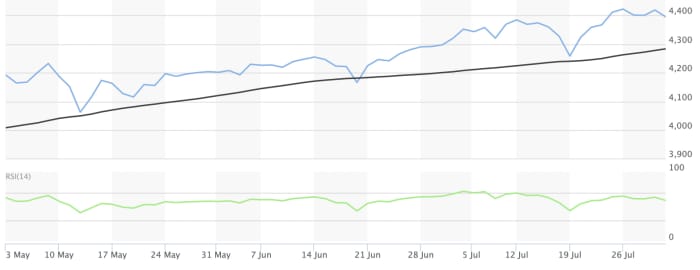

RSI is automatically displayed on almost every stock chart. Below is a screen shot of the Standard & Poor’s 500 SPX, +0.17% index RSI on a weekly chart with a three-month time frame and the 14-day default (recommended).

MarketWatch

The screen shot was taken after the market closed on July 30. RSI as of the close on Aug. 6 rose to 71.1 on the weekly chart, which is extremely overbought. This doesn’t mean to sell everything but it does signal caution as stocks may reverse course — and soon. For comparison, the latest Nasdaq Composite COMP, -0.40% weekly RSI is 66.37 while the Dow Jones Industrial Average DJIA, +0.41% is at 66.31.

Here are some additional facts about RSI:

When RSI rises to 70 and above

- The RSI weekly chart gives a more reliable and accurate signal.

- RSI must be 70 or higher and remain above that level to generate an overbought signal. This is a clue that SPX (or another index or stock) is overbought. Hint: Sometimes indexes or stocks will reverse before reaching 70.

- As every technician knows, just because a stock or index is overbought doesn’t mean it will reverse immediately. Securities can remain overbought for long time periods before reversing.

- Do not use RSI to time when the market may reverse. Instead, use it as a guide.

When RSI falls to 30 and below

When RSI on the S&P 500 (or an individual stock) falls to 30 or below, and remains under that threshold, that is an oversold signal. It doesn’t mean that SPX will reverse to the upside immediately, but the possibility increases (much depends on other factors such as market volatility).

Bierman says that if RSI drops hard and fast (to 40 from 69, for example), even though it may not drop below 30, that hard and fast plunge is a signal that the S&P 500 or other indexes may rally (because the market is oversold).

While some investment professionals preach that you cannot time the markets, in reality, a hard and fast plunge in RSI is an important tell, one that should not be taken lightly or ignored. Always confirm with other indicators (such as moving averages) before acting.

Hint: Often, RSI lingers at or near 50, a neutral signal. This is not an actionable trade. However, when RSI makes an extreme move, either above 70 or close to 30 on the weekly chart, it should get your attention.

Limitations of RSI

Like any indicator, RSI is not perfect. Sometimes certain stocks will remain overbought (at 80 or 90) not for days or weeks, but for months. The longer the stock remains overbought without reversing, the less effective the oscillator. In addition, like many indicators, RSI is not as successful in a low-volatile market environment.

Another weakness of RSI (and other indicators) is that it gives false negatives and false positives. Bierman explains what to do when RSI isn’t working properly: “Any indicator has a flaw. The answer is to combine RSI with other indicators. That cuts down your margin of error.”

In other words, don’t make a trade unless you confirm with other indicators (such as moving averages or MACD).

I know that some of you are distrustful of technical indicators, and wonder if they are even effective. I speak from experience when I say that RSI usually generates reliable signals, especially on the weekly chart. Although not perfect, it is a mistake to ignore or dismiss its message.

Michael Sincere (michaelsincere.com) is the author of “Understanding Options,” “Understanding Stocks,” and his latest, “Make Money Trading Options,” which introduces simple option strategies to beginners.

More: Here’s another sign the bull market is near a peak, and this one bears watching

Plus: Here’s your to-do list before the stock market’s next dive