Shares of Expeditors International of Washington Inc. peeked into positive territory Tuesday, reversing earlier sharp losses, after the airfreight and ocean freight company beat second-quarter profit and revenue expectations, but said the supply-chain problems that have crimped business should continue for the foreseeable future.

“We continued to move unprecedented volumes during the quarter, as ocean and air buy/sell rates remained elevated and volatile, capacity was extremely tight and supply chain disruptions showed now signs of abatement,” said Chief Executive Jeffrey Musser.

The stock EXPD, +0.02% sank as much as 3.6% intraday, before bouncing to close up less than 0.1% at $ 126.62.

The Seattle-based company reported before the opening bell net income that rose to $ 316.4 million, or $ 1.84 a share, from $ 183.9 million, or $ 1.09 a share, in the same period a year ago. That beat the FactSet consensus for earnings per share of $ 1.63.

Revenue increased 49.7% to $ 3.61 billion, above the FactSet consensus of $ 3.40 billion. Meanwhile, costs directly related to transportation and other expenses increased 56.7% to $ 2.60 billion, and salaries and other expenses were up 19.5% to $ 599.8 million.

Among the company’s business units, airfreight services revenue grew 20.0% to $ 1.52 billion, shy of the FactSet consensus of $ 1.59 billion, while ocean freight and ocean services revenue more than doubled, to $ 1.10 billion from $ 489.4 million, to beat expectations $ 975.2 million. Customs brokerage and other services revenue rose 51.4% to $ 987.0 million to top forecasts for $ 944.4 million.

FactSet, MarketWatch

CEO Musser said that while airfreight tonnage and ocean container volumes reached records, and buy and sell rates remained significantly higher than pre-pandemic levels, “it has not been easy,” as port congestion and equipment shortages that mucked up trade flow “were not appreciably better” than they were earlier in the year.

“Currently we do not foresee any meaningful improvements to the operating environment over at least the remainder of the year, as the global infrastructure for moving freight seems nearly stretched to its limit,” Musser said. “Robust demand is bumping up against capacity constraints in the air and ocean markets, all of which is made more challenging by limited warehouse space, staffing constraints, port congestion, equipment dislocations, and driver shortages, not to mention additional disturbances such as the closure of the Yantian port due to a COVID-19 outbreak in May or the blockage of the Suez Canal back in March.”

Also read: Columbia Sportswear says ‘escalating’ freight costs, port congestions are curbing its upside.

More: Santa could be stalled as supply issues put toy sector at risk for the holidays.

Musser remains optimistic that conditions will eventually improve, he just can’t predict when or how.

Cowen analyst Jason Seidl reiterated his market perform rating, but raised his stock price target to $ 139, which nearly 10% above current levels, from $ 109.

“While the company does not offer guidance, it appears trends in the near term continue to hold steady and strong, while an eventual stabilization of rates and imbalance will normalize over time,” Seidl wrote in a note to clients. “We expect the normalization story to likely play out in 2022, given industry commentary we have heard throughout Q1 earnings.”

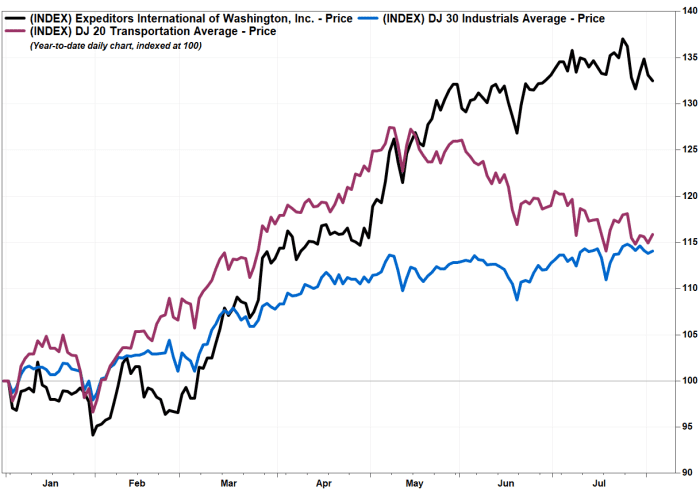

Expeditor shares have run up 11.3% over the past three months, while the Dow Jones Transportation Average DJT, +1.45% has dropped 6.7% and the Dow Jones Industrial Average DJIA, +0.80% has gained 2.9%.