The price band of the initial public offering (IPO) of Krsnaa Diagnostics, which opens on August 4, has been fixed at Rs 933-954 per share, reports suggest.

The offer will close on August 6. Anchor investors’ book, if any, will open for a day on August 3.

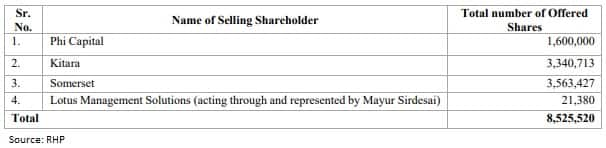

The public issue comprises a fresh issue of Rs 400 crore and an offer for sale of up to 85,25,520 equity shares by existing selling shareholders.

The offer for sale consists of sale of 16 lakh equity shares by PHI Capital Trust-PHI Capital Growth Fund-I; 33,40,713 equity shares by Kitara PIIN 1104; 35,63,427 equity shares by Somerset Indus Healthcare Fund I; and 21,380 equity shares by Lotus Management Solutions (acting through Mayur Sirdesai). The total offer size comes to Rs 1,213.33 crore.

The offer includes a reservation of Rs 20 crore worth of shares for employees, who will a discount of Rs 93 per share to the final issue price.

The company will utilise net proceeds of the fresh issue for establishing diagnostics centres at Punjab, Karnataka, Himachal Pradesh and Maharashtra; repaying of debts; and general corporate purposes.

Investors can bid for a minimum of 15 equity shares and in multiples of 15 equity shares thereafter.

Krsnaa Diagnostics provides a range of technology-enabled diagnostic services such as imaging (including radiology), pathology/clinical laboratory and tele-radiology services to public and private hospitals, medical colleges and community health centres pan-India.

To Know All IPO Related News, Click Here

The company also operates one of India’s largest teleradiology reporting hubs in Pune that is able to process large volumes of X-rays, CT scans and MRI scans round the clock and 365 days a year. Since inception, it has served more than 2.3 crore patients.

As of June 2021, the company has deployed 1,797 diagnostic centres pursuant to public private partnership (PPP) agreements with public health agencies. In addition to the PPP segment, it has expanded from operating 20 diagnostic centres as of March 2021 to 26 such diagnostic centres as of June 2021.

Rajendra Mutha is the promoter of the company. He holds a 29.53 percent stake in the company, while selling shareholders – Phi Capital, Somerset, and Kitara held 23.42 percent, 16.38 percent and 16.38 percent stake, respectively.

JM Financial, DAM Capital Advisors, Equirus Capital, and IIFL Securities are the book running lead managers to the issue.

Krsnaa Diagnostics IPO will be among four public issues to open on August 4 along with Devyani International, Windlas Biotech, and Exxaro Tiles.