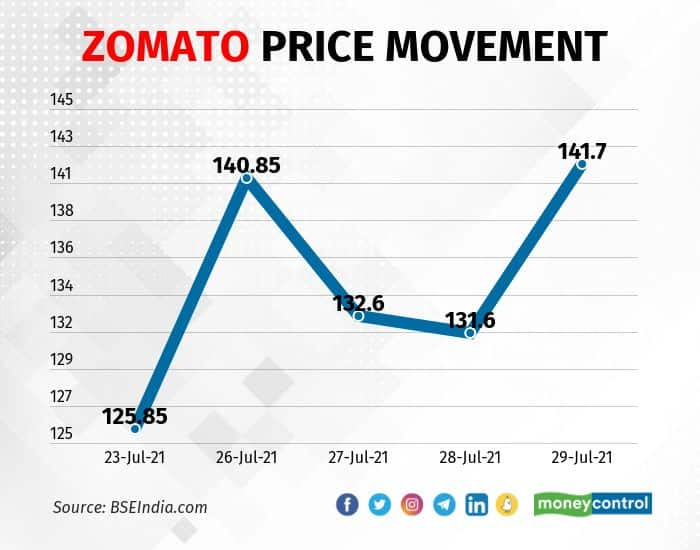

When the much-awaited Zomato stocks listed on July 23, investors were quick to punch in their buy orders instead of food orders, pushing the company’s market capitalisation beyond the Rs 1 lakh crore mark on its debut.

The stock listed at a premium of more than 50 percent over its issue/offer price of Rs 76 a share. The food delivery company’s shares surged about 85 percent from the issue price over five trading sessions and the rally could continue.

However, it may not be a vertical climb for Zomato because most brokerage firms that have rated the stock a buy after its listing do not estimate a more than 17-20 percent gain in the next one year from the July 29 closing price of Rs 141 on the BSE.

Zomato’s Rs 9,375-crore initial public offering on July 14-16 was subscribed 38.25 times, the most in the past 13 years for IPOs valued at more than Rs 5,000 crore.

Investors may complain that Zomato’s valuations are slightly higher than those of global peers, but the growth potential is huge and justifies the premium, experts suggested.

Also read: What caused a bumper rally in Zomato stock on debut?

UBS initiated coverage on Zomato this week with a buy rating and set a target price of Rs 165, a gain of about 17 percent from the July 29 close.

The Swiss brokerage expects Zomato to deliver CAGR of over 40 percent in revenue, making it one of the fastest-growing internet companies in the region. The food delivery market is at a nascent stage compared with global peers.

While FY21 was a seminal year for food delivery in India due to COVID-19 restrictions, it remains low as a percentage of the food services market at 10 percent compared with 20 percent in China. The food services sector, as a percentage of total food spending, is 10-11 percent in India compared with 45-50 percent in China and the US, according to UBS.

With 10 million active users and 50-70 million total online orders in India (China 500-550 million and the US 100-125 million), there is a long runway for growth, UBS said.

In terms of valuation, Zomato’s FY24e EV to sales of 17x compares with 2x-9x for the global food delivery businesses, although its growth is higher at 40-50 percent compared with 20-30 percent for other platforms.

Also read: Sanjeev Bikhchandani: Zomato a validation, public proof of what we knew and believed all along

“In e-commerce, EM platforms such as Sea, MELI and Allegro trade at a premium to Chinese and DM peers due to superior growth rates. Zomato’s EV to sales vs sales growth is at 37x vs 7x-45x for peers,” UBS said.

The food services business in India is slated to be a $ 110 billion opportunity by CY25, according to estimates by Redseer. Zomato, with its strong balance sheet, presence across the value chain and favourable industry tailwinds, can be a major beneficiary, experts said.

Domestic brokerage firm JM Financial, which initiated coverage on Zomato with a buy rating and a 12-month target price of Rs 170, expects the company to deliver GOV/revenue CAGR of 48 percent over FY21-26 in its flagship food delivery business.

“We also expect a strong ramp-up in the Hyperpure business (revenue CAGR of 59 percent) but note that the decision to shut international market operations would negatively impact dining-out business in the near term,” JM Financial said in a report. Hyperpure is Zomato’s supply platform for restaurants.

Zomato is poised to leverage the decadal growth opportunity in the on-demand hyperlocal delivery ecosystem. The company is a leader in food delivery and, like some of its global peers, could explore adjacent growth opportunities.

JM Financial forecasts 46 percent revenue growth at the group level for Zomato over five years. Growth will also come from leveraging other platforms.

It expects Zomato to aggressively explore growth opportunities beyond food services based on its balance sheet strength, recent investments in Grofers (grocery delivery), Fitso (healthy food and snacks) and global peer trends.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.