One of the most responsible modes of investing is to invest in ESG stocks. This not only prioritizes financial returns but also puts the impact of a company on the environment, its stakeholders, and the planet very seriously.

ESG has shown remarkable financial performance which has drawn a lot of investor attention. This is mainly due to the fact that during these turbulent times of the pandemic, ESG showed track records of low volatility compared to non-ESG companies.

To have a better understanding of ESG we decided to talk to two veterans on the subject. These smallcase Managers have specialised smallcases for ESG alone and could help shed some light on the topic.

Ms. Salonee Sanghvi, Founder of My Wealth Guide, and Mr. Arvind Kothari, Founder of Niveshaay Investments took the time to answer some of our basic ESG questions.

What is ESG?

Salonee Sanghvi:

E – Environment, the use of natural resources by the company, and the effect of its operations on the environment.

S – Social, relates to the company’s relationships with people and institutions in the communities where it does business including its employees, suppliers, customers, and society at large.

G – Governance, the internal systems the company adopts to govern itself, the rights and responsibilities of the company.

Contrary to belief, interest in ESG is not only in demand by the younger millennial investors who are more socially conscious, but also large institutional investors.

ESG funds are amongst the fastest growing globally, with almost 25% of institutional investors now branded as ESG. They’ve grown at about 22% per annum since 2006.

How Does ESG impact companies?

Salonee Sanghvi:

ESG principles essentially help companies make better and more efficient use of resources – whether natural and man-made. This helps businesses sustain for longer – with the same “limited” pool of resources.

Growth in Topline –

Companies are better at developing long-term sustainable business plans. Authorities also trust such companies more, enabling them to gain quick approvals leading to top-line growth. Increases brand loyalty, McKinsey research has shown that customers say they are willing to pay to “go green.”

Cost Savings –

Effective utilization of resources leads to cost-saving. Research by MSCI has found such companies to be better managed and more competitive than their peers leading to higher profitability and free cash flow.

Minimizing Regulatory Intervention –

Helps engender government support and ease regulatory pressure. It also helps reduce companies’ risk of adverse government action. There are many examples of projects not taking off due to opposition from the local community.

Higher Productivity –

Attract and retain better quality employees and increase productivity overall. Higher employee satisfaction is positively correlated with shareholder returns, generating higher returns of almost 3-4%.

Lower Risk –

Better risk management and compliance mechanisms reduce the probability of occurrence of any extreme events like fraud, litigation, etc. Higher risks result in bigger drawdowns. Non-ESG companies could bear almost 28% more risk.

Enhanced attention from institutional investors –

Foreign investors especially in India usually prefer companies with good ESG business practices. The information asymmetry is also a factor since high ESG companies are usually more transparent.

Higher Valuations & Return to Shareholder –

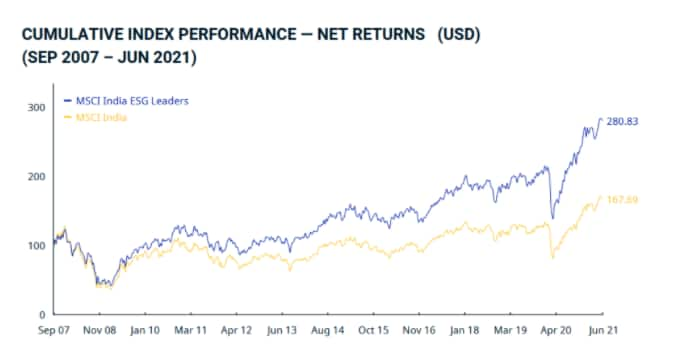

All of these factors result in companies commanding higher valuation. They also tend to be less volatile with lower betas. In fact companies hit by major ESG events saw their stocks underperform by 12% vs the index. The outperformance can be seen in the chart below

How to invest in Top ESG companies?

Salonee Sanghvi:

MWG ESG follows an ESG + Quant strategy to eliminate human biases in investing. Developed by Salonee Sanghvi, CFFA after 17 years of experience in the financial markets it follows a bottoms-up approach without a sector bias.

A diversified portfolio that picks from Top 80 ESG ranked companies with strong risk management systems to ensure the downside is protected while giving you the full upside.

Why ESG?

Arvind Kothari:

ESG and long-term recovery goes hand-in-hand. Environment, Social, and Governance (ESG) investing was important before, but covid-19 hits the business in the worst way, ESG becomes even more significant for both the businesses and investors.

Environmental, Social, and Corporate Governance (ESG) investing growth is estimated at 15% CAGR ($ 53.7 trillion for CY2012-22) according to KEI estimate.

India ranks 117 among 193 UN members, on sustainability index. 80% of Nifty 50 companies are making public their ESG compliance data, while many more have begun building ESG into their operations. Covid-19 makes us identify that business must work in harmony.

Regulators are pressurizing more on companies to provide disclosure according to the specified principles. Recently, SEBI has issued new sustainability-related reporting requirements for the top 1,000 listed companies by market capitalization, earlier it was 500.

The new reporting requirements, which are called Business Responsibility and Sustainability Reporting (BRSR), promote transparent and standardized disclosures on ESG parameters.

What are the benefits?

Implementation of ESG can reduce cost substantially, by shifting to green energy sources for the production of energy can reduce operating costs.

ESG theory helps companies to attract and retain quality employees while enhancing motivation and increasing productivity among them, which positively impacts job satisfaction. Valuing nature and providing safety for employees can enable companies to get easier regulatory compliance.

It also helps in allocating capital in the most effective, promising, and sustainable assets, which will directly help in reducing emissions and wastages, which contribute to the environmental safety.

Accurate and Transparent Financial disclosure by companies, help both Investors as well as Companies, investors are more willing to buy stock in a company, when they clearly understand the company’s finances. It helps investors to hold investments for the long term while getting growth on investments.

Investors in today’s world are not investing for the short term, rather they are more focused on investing for the long term by reviewing disclosures made by companies and then making investment decisions.

A transition to clean energy is also a theme that is compliant with ESG norms. After the detailed research on Green Energy space, we have designed ‘Green Energy Portfolio’

This is a portfolio of stocks, which will benefit from the energy transition that refers to the global energy sector’s shift from fossil-based systems of energy production and consumption to green energy sources like wind and solar, as well as other sources like biofuels.

ESG investing is definitely the way to go to build a sustainable business model. The future of investing is clean and definitely green. You can invest in ESG stocks through the above-mentioned smallcases!

(This is a partnered post)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.