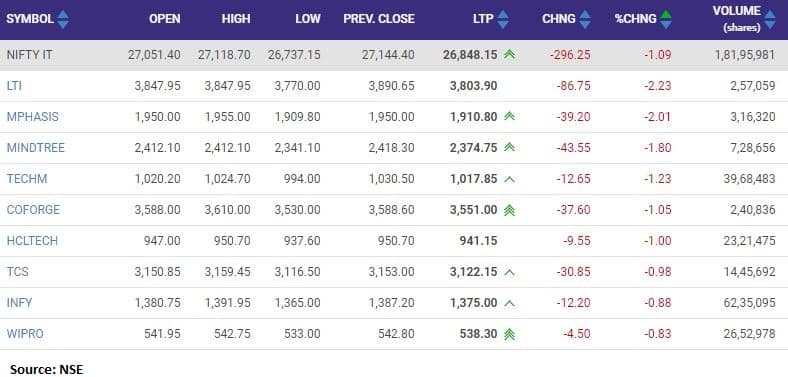

Indian stock market has slipped further into the red on June 2 dragged by IT stocks. Sensex is down 350.88 points or 0.68 percent at 51584.00, and the Nifty shed 76.10 points or 0.49 percent at 15498.80.

The IT index is down over a percent and is the underperforming sector dragged by L&T Infotech and Mindtree which are down 2 percent each. The other losers included Mphasis, Tech Mahindra, Tata Consultancy Services, HCL Tech, Infosys and Coforge among others.

Shitij Gandhi, Senior Technical Analyst at SMC Global Securities has a buy rating on Infosys with a target of Rs 1,500 per share. Last week, this stock gave a fresh breakout above Rs 1,375 after consolidating in a range of Rs 1,310-1,375 for nearly five weeks.

“However, after testing Rs 1,416, it witnessed a pullback towards Rs 1,390 once again. The breakout was observed with rising volumes which suggest the strength in the current trend,” he said.

Brokerage firm KR Choksey has a buy on Tata Consultancy Services with a target raised from Rs 3,580 to Rs 3,700 and an accumulate rating on Wipro with a target of Rs 555 per share.

The second wave of COVID-19 has triggered some supply-side disruptions for IT companies. The firms are, however, managing these pressures through cross-skilling under-utilised talent and diversifying delivery to nearshore and offshore centres outside India, said Prabhudas Lilladher.

The brokerage firm believes that headwinds of the supply-side can be partially offset by levers such as pyramid optimisation, increase in offshoring, controlling attrition and leveraging revenue growth.

“TCS, Infosys are our top picks. We believe that TCS has the ability to gain market share while managing supply-side pressures. We are also impressed by a turnaround in Wipro. In midcap our pecking order is MTCL, Coforge, LTI, Mphasis & LTTS-Cyient in ER&D space,” the research firm added.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.