Kotak Institutional Equities has downgraded JSW Steel to reduce from buy as valuations are rich. It has a target of Rs 640 a share. The brokerage firm believes that steel margin increased to record high levels. It feels that steel price hikes, despite cost inflation, should further expand margin.

Representative Image

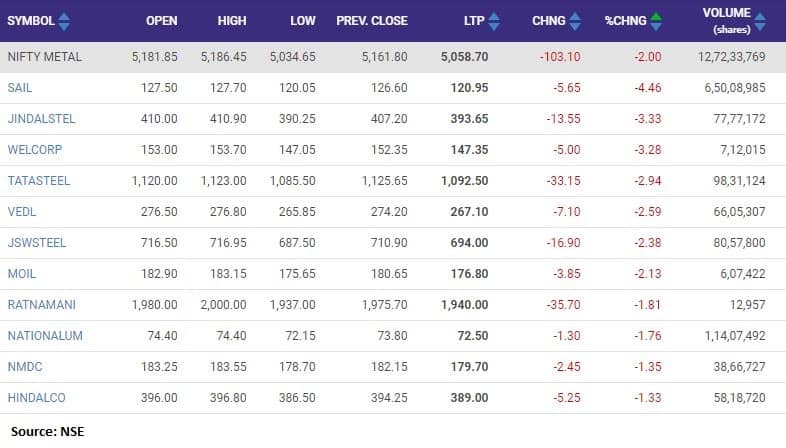

Indian stock market is trading flat on June 1 dragged by metal stocks. The sentiment was also weighed after India’s manufacturing PMI came in at an 8-month low of 50.8.

Sensex is down 86.39 points or 0.17% at 51851.05, and the Nifty shed 40.80 points or 0.26% at 15542.

Among the sectors, the metal index shed over 2 percent dragged by SAIL, Tata Steel, Jindal Steel & Power, JSW Steel and Hindustan Copper which shed 3-5 percent each.

Since February 16, the Nifty Metal index has given a return of up to 41 percent. Experts point out that metal stocks have done remarkably well in the last few months amid expectations of large infra spends by the US and China and talk about a commodity supercycle.

Gautam Duggad, Head of Research at Motilal Oswal Institutional Equities, told CNBC-TV18 that there is still room for more earnings upside in steel companies.

“All largecap steel companies have reduced leverage significantly. Deleveraging for metal companies could continue in FY22. We are slightly overweight on metals,” Duggad said.

Tata Steel posted a consolidated profit of Rs 6,644.1 crore for the quarter ended March 2021 compared to a loss of Rs 1,481.3 crore in the year-ago quarter.

Foreign research firm Morgan Stanley has an overweight rating with a target of Rs 1,000, while CLSA has a buy rating with a target of Rs 1,150 per share.

However, global research firm Credit Suisse downgraded Tata Steel to neutral from outperform with a target of Rs 1,250 per share.

It has also downgraded JSW Steel to underperform from neutral with a target of Rs 550 per share.

Domestic brokerage firm Kotak Institutional Equities has downgraded JSW Steel to reduce from buy as valuations are rich. It has a target of Rs 640 a share. The brokerage firm believes that steel margin increased to record high levels. It feels that steel price hikes, despite cost inflation, should further expand margin.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.