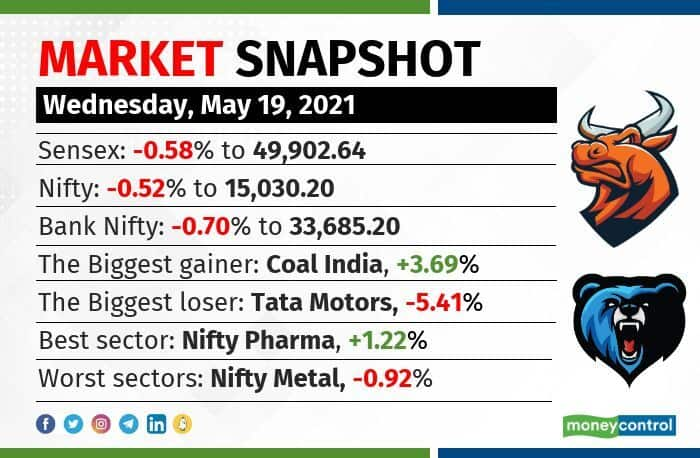

The market ended lower in a volatile session on May 19. Sensex fell 290.69 points or 0.58% to close at 49,902.64, and the Nifty dopped 77.90 points or 0.52% to end at 15,030.20.

Among sectors, Nifty Pharma index gained 1 percent, while the metal index shed 1 percent. Selling was also seen in auto, bank and infra names. BSE Midcap and smallcap indices ended in the green.

“The recent sharp rally has triggered some caution for the near-term. The global market was tentative ahead of the announcement of Fed minutes, this was mirrored in the domestic market, though it is not expected to be hawkish. Optimism gained from declining COVID cases resisted a sharp correction in the domestic market,” said Vinod Nair, Head of Research at Geojit Financial Services.

Tata Motors, HDFC, JSW Steel, M&M and Bajaj Finserv were among the top losers on the Nifty. Gainers included Coal India, Cipla, Sun Pharma, UPL and IOC.

Stocks & sectors

On the BSE, realty, power and healthcare indices rose 1-2 percent, while metal, bank and auto indices ended in the red.

Among individual stocks, a volume spike of more than 100 percent was seen in Canara Bank, Torrent Pharma and SUN TV.

A long buildup was seen in Voltas, Canara Bank and Axis Bank, while a short buildup was seen in Coforge, PI Industries and Aarti Industries

More than 300 stocks, including CSB Bank, Gland Pharma and Adani Enterprises, hit a fresh 52-week high on the BSE.

Technical View

Nifty formed a bearish candle on the daily scale and negated its higher highs – higher lows formation of the last two sessions.

“Nifty has to hold above 14,950-15,000 zones to witness an up move towards 15,200 then 15,350 zones. On the downside, support exists at 14,900 and 14,800 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.