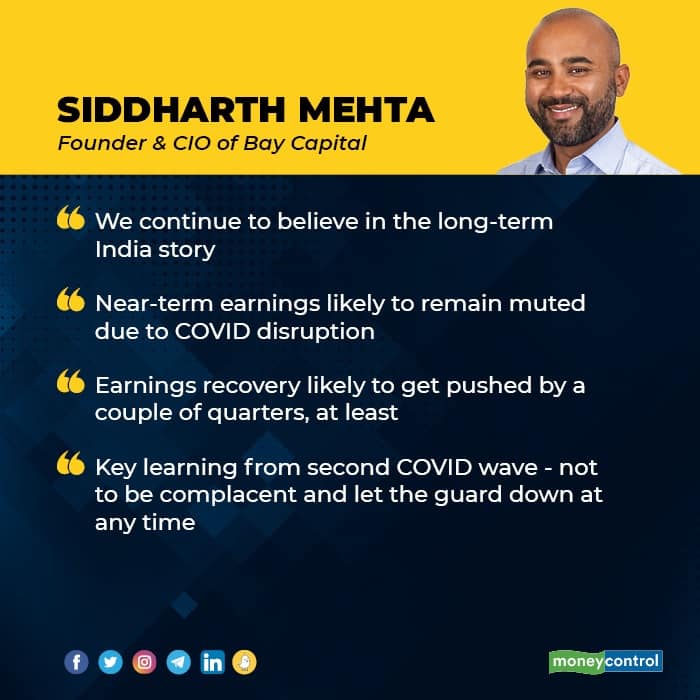

Siddharth Mehta, Founder & CIO at Bay Capital, believes that India’s long-term growth story remains intact, even though near-term headwinds in the face of COVID-19 persist.

Prior to founding Bay Capital, Mehta, a market veteran of 19 years, worked with Kotak Mahindra Group and was instrumental in building its international asset management business.

In an interview with Moneycontrol’s Sunil Shankar Matkar, Mehta said earnings for the next few quarters may remain muted primarily on account of the disruption brought on by the second wave. Edited excerpt:

Q: The mayhem caused by the second wave has fuelled worries of a complete lockdown to stop the surge seen in the daily COVID cases – something which is not factored in by the markets. What is your view on this?

Although there is no national lockdown like the one administered last year, many parts of the country are under restrictions and to that extent economic activity is certainly subdued. The equity markets are perhaps looking for this devastating second wave to pass over the next 2 to 3 months with activity recovering. While the very near-term may see a correction, for us as investors, we neither predict nor try to profit from this. We continue to be believers in the long-term India story and remain convinced that high-quality businesses should be bought into for returns to be generated over a 5 to 7-year time frame.

Q: How have institutional asset allocators rejigged their India strategy after the second COVID wave?

No doubt, the press in the Western world is coming down hard on India’s handling of the second wave. In the near term, allocators remain a little circumspect as the news flow from India on the COVID front is not encouraging. However, longer-term oriented investors are positioned to look beyond the near-term challenges and continue to like India as an investment destination.

Q: What are your view on earnings growth, in the near term and the medium term?

On account of the disruption brought on by the second wave, near-term earnings are likely to remain muted. The commentary from management at the time of the recent quarterly results also point to this. The pace of recovery that we had started to witness from the third quarter of last year is likely to decelerate a bit and the recovery is likely to get pushed out by a couple of quarters at least.

Q: Speciality chemical business has attracted premium valuations. Does the trend continue?

Most of these businesses have seen spectacular appreciation more as a result of multiple expansion along with robust bottomline growth. The broader opportunity set for the high-quality frontline businesses continues to be strong but in certain cases valuations seem to indeed be stretched for the near term.

Q: Your 3-5 key learnings from COVID second wave?

One of the key learnings is not to be complacent and let our guards down at any time. This is true in the context of the pandemic and also in the context of investing.

Another key learning as a result of the events of the last one year for us is that temperament is a key component for success in the world of investing. Through our experience of having navigated through multiple market cycles and crises, we believe that often things are never as great as they seem, nor are things going to get as bad as we might think!

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.