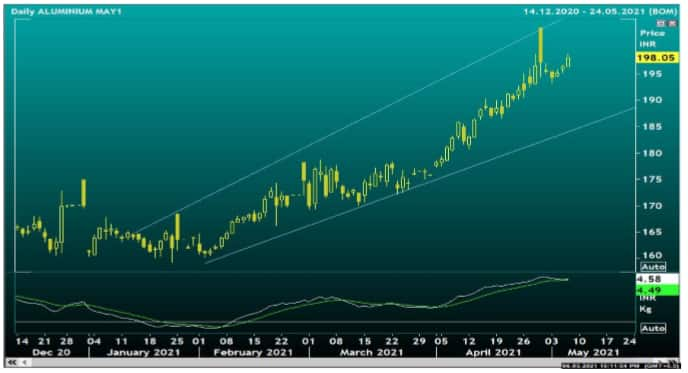

Representative image

Aluminium prices touched a fresh lifetime high on the MCX and near 10-year high on LME near $ 2,500/tonne on weaker dollar, tightness in the physical market, supply concerns in China and decline in stocks at LME warehouses.

Aluminium delivery for May gained Rs 1.80, or 0.92 percent, to Rs 198.20 per kg at 21:31 hours with a business turnover of 1,931 lots. The same for June contract jumped Rs 1.75, or 0.89 percent to Rs 198.20 per kg with a turnover of 218 lots.

The value of May and June’s contracts traded so far is Rs 391.77 crore and Rs 17.73 crore, respectively.

MCX METLDEX rose 51 points, or 0.33 percent, at 15,346 at 21:30. The index tracks the real-time performance of key base metals.

The momentum indicator Relative Strength Index (RSI) is at 77, which indicates a very bullish movement in prices.

Shanghai aluminium tested highest in more than 11 years high on escalating tensions between China and Australia.

Amongst other factors, markets continue to remain supported amid central banks supportive stance and upbeat pace of vaccination.

A gauge for the US dollar, dollar retreated from two-week highs to trade at 90.99.

Yash Sawant, Research Associate, Angel Broking Ltd said, “MCX Aluminium prices posted gains of over 1.3 percent while prices on the LME charged towards the $ 2500 levels on Thursday. Worries over the disruption of the global aluminium supply chain continued to underpin aluminium prices across borders.

After China’s move to clamp down the local polluting industries, mounting tension between Australia (is a major producer of raw materials bauxite and alumina) & China (the top consumer of aluminium) further threatened the global Aluminium supply chain.

China has reportedly suspended the key economic dialogue with Australia, hampering the already bleak relations between the two countries. Ties between Australia and China began to worn out after Australia banned China’s tech giant Huawei back in 2018.

Mounting supply side stress amid an improved demand outlook for aluminium and other industrial metals might continue to support the prices in the near term, Sawant noted.

At 16:03 (GMT), the base metal price was up 1.89 percent and was quoting at $ 2,493.25 per tonne in London.

Trading Ideas

Kshitij Purohit, Product Manager, Currency & Commodities, CapitalVia Global Research Limited said, “MCX Aluminium traded above Rs 198 levels for the first time. The market may marginally decline from the levels of Rs 198-199 and trade near Rs 196.5-197 levels in the second half. Prices have traded with bullish momentum and are likely to sustain above Rs 195-196.5 levels.

Geojit Financial Services

Geojit Financial Services

Geojit Financial Services said present buying sentiments may continue in the coming session. Although, a direct fall below Rs 196.7 may squeeze down prices lower.

For all commodities-related news, click here

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.