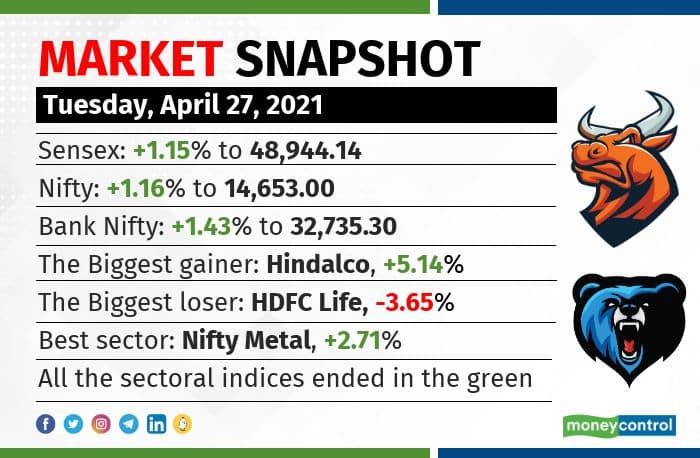

Indian market gained over 1 percent for the second consecutive session on April 27. At close, the Sensex was up 557.63 points or 1.15% at 48,944.14, and the Nifty was up 168 points or 1.16% at 14,653.

All the sectoral indices ended in the green with PSU bank and metal indices rising over 2 percent each, while BSE Midcap and Smallcap indices added 1 percent each.

“Healthy buying across sectors led by banking, metals and specialty-chemicals is leading the rally. Stocks are up in anticipation of good quarterly earnings and improved outlook due to a hike in stock prices and demand,” said Vinod Nair, Head of Research at Geojit Financial Services.

“FIIs continue to be net sellers in the domestic market due to weak Asian markets ahead of US Federal Reserve meeting, but it was more than compensated by DIIs & retail investors,” Nair added.

Hindalco Industries, Tata Steel, Larsen and Toubro, Divis Labs and Bajaj Finance were among top gainers on Nifty, while losers included HDFC Life, SBI Life Insurance, Maruti Suzuki, Nestle and Kotak Mahindra Bank.

Stocks & sectors

On the BSE, the metal index rallied nearly 3 percent and the capital goods sector added over 2 percent.

Among individual stocks, a volume spike of more than 100 percent was seen in Sun TV Network, SRF and NALCO.

Long buildup was seen in Axis Bank, SRF and Muthoot Finance, while a short buildup was seen in Colgate Palmolive, HDFC Life and Berger Paints.

More than 200 stocks including Tata Steel, SAIL, Divis Labs hit a fresh 52-week high on the BSE.

Technical View

Nifty formed a bullish candle on the daily scale and has been forming higher highs – higher lows since the last two sessions.

“Nifty has to continue to hold above 14,400 zones to witness an up move towards 14,600 and 14,700 zones, while on the downside, support exists at 14,300 and 14,150 zones,” said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.