Are you ready for retirement? People get asked this question all the time. But I have a question that might be more productive: What will your retirement look like?

Give me the details. Where will you live? Tell me the exact city, town or region. What will your home be like? How many bedrooms or bathrooms will it have? How much will that home cost?

Now I want to go even further. Tell me the story of your retirement. What will you have for breakfast? What will you do with your Thursdays? Will you volunteer or travel? If you have grandkids, how often will you see them? If you were fortunate enough at the end of your time to have a little money left over, what do you want to do with it? Does it go to those grandkids? Maybe it goes to your local church, school or cat shelter?

In short, what will the future you be like?

Most people don’t give themselves the time or permission to ask themselves these questions. We spend most of our days thinking about our past: successes we had, mistakes we made, things we might have done differently. We spend very little time thinking about the future us.

But it doesn’t matter if you’re just graduating from college, mid-career or in the final stretch of your working days; imagining that future you in detail can be a powerful financial tool to plan for your retirement, or frankly any goal. I call it futurecasting.

First, a caveat. I am not a financial planner nor am I banker. I will not give you financial advice. I am a futurist. What I can do is show you how to think like a futurist and prepare for your tomorrow.

Step 1: Imagine the future you

Human beings are story-believing machines. When we tell ourselves stories about tomorrow, it gives us a tool to actually bring that future about. That’s why the details are so important. They allow you to not only see your future but also to get a sense of what it will be like to live there, what it could smell or taste like, even what it might cost and how you pay for it.

Write down the story of the future you with as much detail as possible. Stretch your imagination. Challenge yourself. The way you change your future is to change the story you are telling yourself about the future you will live in. By imagining in detail your future retirement, you have a powerful tool to make it happen.

Step 2: Identify your future forces

Now that you know the story of the future you, it’s time to start gathering the future forces that will help propel you toward that future. The first thing to do is to identify your people. This could be your partner, family or friends. This is your team. These are the people who will help support you and help you get to the future you.

Then tell them the story of the future you. Get their feedback. They may have a different idea, and it might help evolve and change your plans. By telling people the story of the future you and your retirement, it helps to make that future a reality. Your people will also hold you accountable as you continue to futurecast your retirement.

“ The way you change your future is to change the story you are telling yourself about the future you will live in. ”

Next you’ll want to explore the tools that will help you get to the future you. These could be technology tools, like an app that tracks your finances. But tools can also be websites and blogs that offer advice organizations and clubs that have information or services to help move you toward your goals.

Finally, seek out the experts. These are those who have attained the future you’ve imagined or something close to it. They also can be people with the training and certifications to give you the advice to move toward that future you. By talking to them, you will continue to evolve, modify and change the vision for your retirement. It also will become clearer and more attainable.

Step 3: Backcast from the future to today

With the story of the future you and your future forces in place, it’s time to turn around and look backward. Standing in the future you, look backward toward today. This backcasting will allow you to define the specific steps you can take to attain the retirement you want.

First, think about what will get you halfway. What is the thing that you could achieve that will make you feel like you are halfway to your retirement goals? Write that down.

HarperOne

Next split that in half. What will make you feel that you are partway there? What can you do that will make you feel like you are really headed toward that future you want? Write that down.

Finally, identify what you could do on Monday. What is the small step that you can take or task that you could do that will make you feel like you are meaningfully moving toward that future you? Write that down.

There is a power to writing these things down. Seeing it in your own handwriting makes it both personal and real. You’ll have a plan to refer back to when life gets hectic or you feel a little lost and need to get back on track. Writing it down also will hold you accountable: The future you want is staring back at you and all you need to do is keep going.

A powerful tool

Thinking like a futurist can be applied to any part of your life. You can apply this powerful tool to large or small financial goals: It can help when you plan to buy a home or chart the future of your career or the future of your local community.

As a futurist for the last 25 years I have learned that everybody has the ability to envision, plan and build their future. The first step is to imagine the future you want. Then get started.

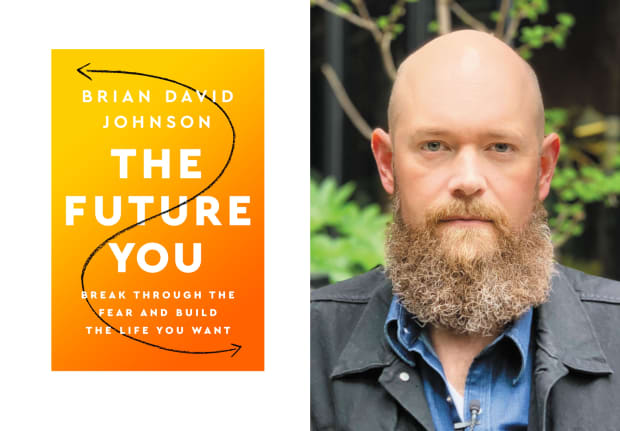

Brian David Johnson was Intel Corp.’s first-ever futurist from 2009 to 2016. He is now a professor at Arizona State University’s Global Futures Laboratory and the School for the Future of Innovation in Society as well as the author of “The Future You: Break Through the Fear and Build the Life You Want.” Follow him on Twitter @BDJFuturist.

Now read: An FBI hostage negotiator reveals the secret to demanding the raise you deserve