The company reported a standalone profit of Rs 2,925.8 crore for the quarter ended December 2020, declining 65.1 percent compared to Rs 8,372.5 crore in the corresponding period.

‘); $ (‘#lastUpdated_’+articleId).text(resData[stkKey][‘lastupdate’]); //if(resData[stkKey][‘percentchange’] > 0){ // $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); // $ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); //}else if(resData[stkKey][‘percentchange’] = 0){ $ (‘#greentxt_’+articleId).removeClass(“redtxt”).addClass(“greentxt”); //$ (‘.arw_red’).removeClass(“arw_red”).addClass(“arw_green”); $ (‘#gainlosstxt_’+articleId).find(“.arw_red”).removeClass(“arw_red”).addClass(“arw_green”); }else if(resData[stkKey][‘percentchange’] 0) { var resStr=”; var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .get( “//www.moneycontrol.com/mccode/common/rhsdata.html”, function( data ) { $ (‘#backInner1_rhsPop’).html(data); $ .ajax({url:url, type:”POST”, dataType:”json”, data:{q_f:typparam1,wSec:secglbVar,wArray:lastRsrs}, success:function(d) { if(typparam1==’1′) // rhs { var appndStr=”; var newappndStr = makeMiddleRDivNew(d); appndStr = newappndStr[0]; var titStr=”;var editw=”; var typevar=”; var pparr= new Array(‘Monitoring your investments regularly is important.’,’Add your transaction details to monitor your stock`s performance.’,’You can also track your Transaction History and Capital Gains.’); var phead =’Why add to Portfolio?’; if(secglbVar ==1) { var stkdtxt=’this stock’; var fltxt=’ it ‘; typevar =’Stock ‘; if(lastRsrs.length>1){ stkdtxt=’these stocks’; typevar =’Stocks ‘;fltxt=’ them ‘; } } //var popretStr =lvPOPRHS(phead,pparr); //$ (‘#poprhsAdd’).html(popretStr); //$ (‘.btmbgnwr’).show(); var tickTxt =’‘; if(typparam1==1) { var modalContent = ‘Watchlist has been updated successfully.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //var existsFlag=$ .inArray(‘added’,newappndStr[1]); //$ (‘#toptitleTXT’).html(tickTxt+typevar+’ to your watchlist’); //if(existsFlag == -1) //{ // if(lastRsrs.length > 1) // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exist in your watchlist’); // else // $ (‘#toptitleTXT’).html(tickTxt+typevar+’already exists in your watchlist’); // //} } //$ (‘.accdiv’).html(”); //$ (‘.accdiv’).html(appndStr); } }, //complete:function(d){ // if(typparam1==1) // { // watchlist_popup(‘open’); // } //} }); }); } else { var disNam =’stock’; if($ (‘#impact_option’).html()==’STOCKS’) disNam =’stock’; if($ (‘#impact_option’).html()==’MUTUAL FUNDS’) disNam =’mutual fund’; if($ (‘#impact_option’).html()==’COMMODITIES’) disNam =’commodity’; alert(‘Please select at least one ‘+disNam); } } else { AFTERLOGINCALLBACK = ‘overlayPopup(‘+e+’, ‘+t+’, ‘+n+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function pcSavePort(param,call_pg,dispId) { var adtxt=”; if(readCookie(‘nnmc’)){ if(call_pg == “2”) { pass_sec = 2; } else { pass_sec = 1; } var url = ‘//www.moneycontrol.com/mccode/common/saveWatchlist.php’; $ .ajax({url:url, type:”POST”, //data:{q_f:3,wSec:1,dispid:$ (‘input[name=sc_dispid_port]’).val()}, data:{q_f:3,wSec:pass_sec,dispid:dispId}, dataType:”json”, success:function(d) { //var accStr= ”; //$ .each(d.ac,function(i,v) //{ // accStr+=”+v.nm+”; //}); $ .each(d.data,function(i,v) { if(v.flg == ‘0’) { var modalContent = ‘Scheme added to your portfolio.’; var modalStatus = ‘success’; //if error, use ‘error’ $ (‘.mc-modal-content’).text(modalContent); $ (‘.mc-modal-wrap’).css(‘display’,’flex’); $ (‘.mc-modal’).addClass(modalStatus); //$ (‘#acc_sel_port’).html(accStr); //$ (‘#mcpcp_addportfolio .form_field, .form_btn’).removeClass(‘disabled’); //$ (‘#mcpcp_addportfolio .form_field input, .form_field select, .form_btn input’).attr(‘disabled’, false); // //if(call_pg == “2”) //{ // adtxt =’ Scheme added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //else //{ // adtxt =’ Stock added to your portfolio We recommend you add transactional details to evaluate your investment better. x‘; //} //$ (‘#mcpcp_addprof_info’).css(‘background-color’,’#eeffc8′); //$ (‘#mcpcp_addprof_info’).html(adtxt); //$ (‘#mcpcp_addprof_info’).show(); glbbid=v.id; } }); } }); } else { AFTERLOGINCALLBACK = ‘pcSavePort(‘+param+’, ‘+call_pg+’, ‘+dispId+’)’; commonPopRHS(); /*work_div = 1; typparam = t; typparam1 = n; check_login_pop(1)*/ } } function commonPopRHS(e) { /*var t = ($ (window).height() – $ (“#” + e).height()) / 2 + $ (window).scrollTop(); var n = ($ (window).width() – $ (“#” + e).width()) / 2 + $ (window).scrollLeft(); $ (“#” + e).css({ position: “absolute”, top: t, left: n }); $ (“#lightbox_cb,#” + e).fadeIn(300); $ (“#lightbox_cb”).remove(); $ (“body”).append(”); $ (“#lightbox_cb”).css({ filter: “alpha(opacity=80)” }).fadeIn()*/ $ (“#myframe”).attr(‘src’,’https://accounts.moneycontrol.com/mclogin/?d=2′); $ (“#LoginModal”).modal(); } function overlay(n) { document.getElementById(‘back’).style.width = document.body.clientWidth + “px”; document.getElementById(‘back’).style.height = document.body.clientHeight +”px”; document.getElementById(‘back’).style.display = ‘block’; jQuery.fn.center = function () { this.css(“position”,”absolute”); var topPos = ($ (window).height() – this.height() ) / 2; this.css(“top”, -topPos).show().animate({‘top’:topPos},300); this.css(“left”, ( $ (window).width() – this.width() ) / 2); return this; } setTimeout(function(){$ (‘#backInner’+n).center()},100); } function closeoverlay(n){ document.getElementById(‘back’).style.display = ‘none’; document.getElementById(‘backInner’+n).style.display = ‘none’; } stk_str=”; stk.forEach(function (stkData,index){ if(index==0){ stk_str+=stkData.stockId.trim(); }else{ stk_str+=’,’+stkData.stockId.trim(); } }); $ .get(‘//www.moneycontrol.com/techmvc/mc_apis/stock_details/?sc_id=’+stk_str, function(data) { stk.forEach(function (stkData,index){ $ (‘#stock-name-‘+stkData.stockId.trim()+’-‘+article_id).text(data[stkData.stockId.trim()][‘nse’][‘shortname’]); }); });

Housing Development Finance Corporation (HDFC) share price slipped in the early trade on February 3 after the company announced its December quarter earnings a day before.

The company reported a standalone profit of Rs 2,925.8 crore for the quarter ended December 2020, declining 65.1 percent compared to Rs 8,372.5 crore in the corresponding period. The profit in Q3FY20 includes proceeds from stake sale in GRUH Finance which was merged with Bandhan Bank in October 2019.

Net interest income, the difference between interest earned and interest expended, grew by 26 percent YoY to Rs 4,068 crore in Q3FY21.

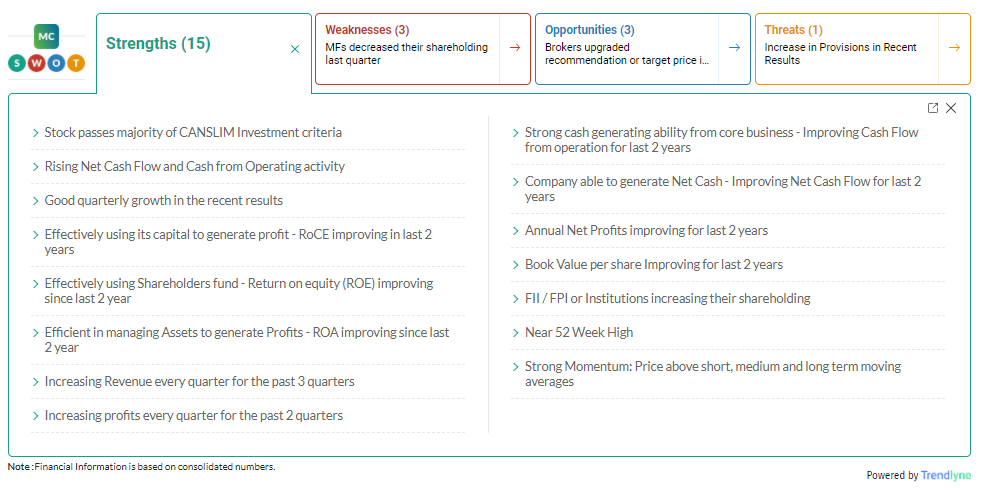

Here is what some brokerages have to say about the stock and the company after the Q3 numbers:

Credit Suisse

Research house has kept outperform rating and raised target to Rs 2,950 per share. The individual growth remains strong and asset quality stable with healthy provisioning. It’s comfortably capitalised & beneficiary of low funding costs.

The incremental provisioning to be limited with healthy provisions & recovery in realty sales. The EPS estimates rise by 7-8% on stronger growth, reported CNBC-TV18.

Morgan Stanley

Morgan Stanley has maintained overweight call and target raised to Rs 3,200 per share. The retail disbursements & revenue momentum are strong, while strong provisioning coverage & potential for write-backs should whet risk appetite.

Investors see company as a play on a nascent recovery in real estate. The valuation could re-rate from 5-year average level, reported CNBC-TV18.

Jefferies

Research house Jefferies has maintained buy rating and raised target to Rs 3,340 from Rs 3,170 per share.

The Q3 profit led by better topline, while the two key positives are strong disbursement growth & stable asset quality. It is well placed to leverage housing demand & potential construction financing.

The loan growth can improve from 9-10% to 15% over FY22-23. Jefferies raise estimates by 5-6% to factor in a better topline & lower provisions, reported CNBC-TV18.

CLSA

CLSA has maintained outperform and raised target to Rs 3,000 from Rs 2,850 per share. The Q3 performance is strong, with a big beat on NII. It has adequate provision of 1.4% of AUMs and NIMs improved by 20 bps QoQ is a positive surprise.

CLSS raises FY22/23 earnings estimates by 4-5% on higher margins. It has built adequate buffers & provisioning should normalise during FY22/23, reported CNBC-TV18.

Prabhudas Lilladher

Not just supported by other income gains, but also core profitability and controlled asset quality, Q3FY21 proved to be a healthy quarter for HDFC. The biggest positive came in the form of improved asset quality on the back of (a) GNPA at 1.9% (vs our estimates of 2.1%), (b) restructured book restricted to 0.9%, (c) collection efficiency for individual home loans climbing to ~98% and (d) consistent high order PCR at 49%.

Robust collection efficiency into retail loan book at 98%+ led by stronger recoveries and sustenance of pricing power (3.4% NIMs) defying competition further reinforces our confidence in the continued growth story of HDFC Ltd. We upgrade HDFC to buy (earlier accumulate) and our SoTP now stands at Rs 3,094 (earlier Rs 2,895) with standalone valued at Rs 1,668 and subsidiaries at Rs 1,427.

Motilal Oswal

3QFY21 was a strong quarter on all fronts. Disbursements have been picking up MoM and have crossed YoY levels over the past quarter. With declining cost of funds and reduction of excess liquidity on the balance sheet, margins should be stable despite pressure on retail lending yield.

We expect HDFC to report core RoA/RoE of 2%/13% over FY22–23E. Reiterate buy, with SOTP-based target price of Rs 3,300 (FY23 SOTP-based)

Sharekhan

HDFC is currently available at 4.8x / 4.4x its FY2022E / FY2023E adjusted book value, which we believe is reasonable considering its robust operating metrics, pedigree, strong brand recall across product categories, and a sustainable business model.

We believe that the consistency and relative outperformance of HDFC will help it sustain growth as well as valuations. We maintain a buy rating on the stock with a revised SOTP-based price target of Rs. 3,100.

At 09:18 hrs Housing Development Finance Corporation was quoting at Rs 2,636.20, down Rs 22.80, or 0.86 percent on the BSE.

The share touched its 52-week high Rs 2,777.70 and 52-week low Rs 1,473.10 on 13 January, 2021 and 24 March, 2020, respectively.

Currently, it is trading 5.09 percent below its 52-week high and 78.96 percent above its 52-week lo