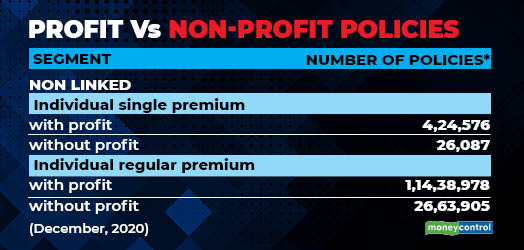

Life insurers are struggling to sell traditional guaranteed return plans in the market amid the coronavirus. Why? Customers are keen to buy with-profit products—also known as participating products. The lure of these products is that they help policyholders get a cut of the profits of an insurance company in the form of bonuses or dividends. Customers don’t mind paying higher premiums to buy participating products for fear of losing out. Data shows there were 11.8 million with-profit policies as against 2.6 million without-profit bought by individual customers between April 1 and December 31. A strong distribution network thought might help insurers overcome a tough year and earn some profits.